05/09/2025 – Promising markets for manufacturers of wire, cable and tubular goods

Huge demand for wire, cables, tubes and pipes

Egypt, a country with more than 116 million inhabitants, is part of the Middle East and North Africa region with more than 508 million inhabitants. Egypt’s economic power – the IMF expects economic growth of 3.8% in 2025, rising to 4.1% in 2026 – and its access to the Middle East and African (MEA) region make Egypt an interesting market and production location.

Since wires, tubes and their derivates such as cables, springs and fasteners are needed in all areas of society, the Middle Esat Africa states create a broad market for these industries and their suppliers. Thus, the market is looking eagerly towards the trade fairs wire/Tube Middle East Africa from September 6 to 8, 2025.

Increasing electric power demand

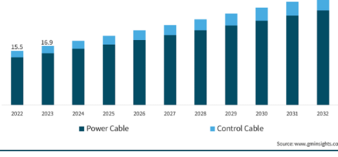

Wires and cables are indispensable for the transmission of electric power and electronic data. Market surveys give an idea of the market size. The market research company Global Market Insights GMI, for example, valuated the size of the power and control cable market of the MEA region at nearly US$17 bn in 2023 and expects it to grow at a compound annual growth rate (CAGR) of over 6.9% between 2024 and 2032 to more than US$31 bn with the power cable segment projected to surpass US$27 bn in 2032 (fig. 1).

Market drivers are investments in infrastructure including upgrading of aging power infrastructure, building projects including data centers, the backbone of Artificial Intelligence (AI), and the integration of digitized control systems. These activities have led to an increased demand for cables.

Egypt, for example, with a power consumption of 219 TWh in 2023 behind South Africa the second-largest power consumer of Africa, is expected to see a 2% annual consumption growth rate until 2026 and allocated US$2.5 bn to ensure stability of electricity supplies. The country has to cope, among others, with power outages due to a surging residential demand and a growing power demand for ventilation systems due to higher temperatures.

As reported in the daily newspaper Arab News, also other governments of the MEA region are investing billions of dollars in power generation [1]. In the four years to 2023, the region’s total installed generation capacity increased by 15% to exceed 462 GW. Total capacity will need to increase by 40% by 2030 compared to a decade earlier.

The bulk of generated electricity is consumed by households, accounting for 40% of the total consumption, and commercial buildings, rather than industrial production. Deploying smart technologies in buildings, particularly those that optimize air-conditioning efficiency, can reduce energy consumption without compromising economic growth.

Increasing water demand

Pipes, tubes and hollow profiles are necessary for the transmission of liquids, gases, free-flowing substances and for mechanical structures. These tubular products are important for Middle East and Northern Africa. Getting hotter and drier, the region is considered the most water-scarce region in the world. Its countries are taking steps to ensure a water-secure future for their citizens. The World Bank supports these countries and holds ready a UD$2.6 bn water portfolio including support to improve irrigation for agriculture, provide safe drinking water, safeguard oases, reduce systemic water losses and clean up beaches, cities and rural communities through better treatment of wastewater. Pipes made from Polyethylene (PE) are often used across systems for water supply and irrigation, sewerage and drainage as well as gas supply und slurry lines. These pipes facilitate an efficient application due to their properties such as mechanical strength, elasticity, corrosion resistance, chemical durability and UV resistance combined with their ease of installation.

The market research company Expert Market Research valued the PE pipes market of the MEA region at US$2.3 bn in 2024. The industry is expected to grow at a CAGR of 7.7% during the period of 2025-2034 to attain a valuation of about USD 4.9 bn by 2034.

With regard to copper pipes and tubes market in the MEA region, the market researchers of Grandview Research quantified the revenue of at US$263 mn in 2024 and expect it to reach a revenue of nearly US$ 330 mn by 2030. A CAGR of 2.8% is expected from 2025 to 2030 (Fig. 2). They found out that in 2024 HVAC (heating, ventilation and air-conditioning systems) was the largest revenue generating application while electrical & electronics were the most lucrative application segment registering the fastest growth. Another finding was that in terms of revenue, the MEA region accounted for 1.1% of the global copper pipes and tubes market in 2024.

Outlook

In view of challenging market requirements, manufacturers in the MEA region who produces wire, cable and tubular products need up-to-date equipment to remain competitive. The wire/Tube Middle East Africa trade fairs provide an ideal opportunity for equipment manufacturers to show their innovations while the visitors get access to information about the state-of-the-art.

[1] Jessica Obeid: MENA’s electricity demand crunch and the path to sustainability. In: Arab News, March 9, 2025. https://www.arabnews.com/node/2593006

www.wire-mea.com | www.messe-duesseldorf.de | www.wire.de

Messe Düsseldorf GmbH

Messeplatz, Stockumer Kirchstrasse 61

40474 Düsseldorf/Germany

Tel.: +49 211 4560-01

info@messe-duesseldorf.de

www.messe-duesseldorf.de