10/09/2025 – wire/Tube Southeast Asia 2025

Vast market possibilities for the wire, cable and tube industries

Southeast Asia has nearly 700 million inhabitants according to Worldometer who live mainly in one of the ten states of the ASEAN organization. Between 2010 and 2022 this community each year achieved a total economic growth of nearly 4.4% on average.

The countries of Southeast Asia create a vast market. Thus, the industry is looking eagerly to the trade fairs “wire/Tube Southeast Asia” in Bangkok from September 17 to 19, 2025. © Messe Düsseldorf

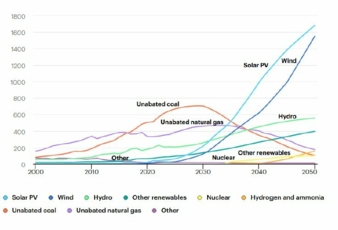

Fig. 1. Electricity generation by source in Southeast Asia ((the figures for 2025 to 2050 are estimated values). y-axis: Electricity amount (in TWh) x-axis: Period of time. Source: https://www.iea.org/reports/southeast-asia-energy-outlook-2024/executive-summary?utm_source=chatgpt.com © Messe Düsseldorf

As of 2024, the region's combined gross domestic product reached nearly US$4 trillion, ranking it as the fifth-largest economy of the world. The ASEAN Economic Community Strategic Plan 2026 – 2030 adopted by the ASEAN leaders in May 2025 sees the region poised to ascend to the world’s fourth largest economy.

Since wires, tubes and their derivates such as cables, springs, fasteners and pipe fittings are needed in all areas of society, the countries of Southeast Asia create a vast market for these industries and their suppliers. Thus, the industry is looking eagerly to the trade fairs “wire/Tube Southeast Asia” in Bangkok from September 17 to 19, 2025.

Wires and cables

Wires and cables are necessary for the supply of electric power and electronic data. The market research company Cognitive Market Research estimates that the Southeast Asian wire and cable market will reach a revenue of nearly US$5.2 bn in 2025 and grow to US$9.3 bn in 2033 at a compound annual growth rate (CAGR) of about 7.6%. Significant market drivers are the region's rapid urbanization, the implementation of air conditioners in buildings due to the climatic conditions in Southeast Asia, expanding industrial activities and the expansion of communication networks with data-intensive applications. These sectors require a reliable supply of electricity and thus big amounts of cables. The same can be said of infrastructure projects concerning power plants and power transmission and distribution networks which are needed to meet the electricity demand.

Another large consumer of wires and cables is the transport sector, including electric vehicles and their charging infrastructure. According to the Southeast Asia Energy Outlook 2024 report of the International Energy Association (IEA), electric mobility is only beginning, but there are already striking data points: the share of electric cars in total sales reached 15% in Vietnam in 2023 and 10% in Thailand. Electric two-wheelers are a further major potential source of growth.

In short, ASEAN’s electricity demand is rising rapidly. Demand is expected to rise from over 1,300 TWh in 2023 to above 2,000 TWh by 2035. This is driven by the buildings sector, where air conditioning (AC) usage is surging, followed by transport and industry. More than 15% of electricity used in buildings is for AC; this figure will grow to around 30% by 2035. In Indonesia, e.g., the share of households with ACs will increase from 15% today to 50% by 2035. As a consequence, ASEAN’s electricity generation is increasing too. According to the IEA, the total electricity generation in the region amounted to more than 1,110 TWh in 2020 and is projected to reach about 1,450 TWh in 2025 and nearly 1,830 TWh in 2030 (Fig. 1).

Tubes and pipes

Tubes and pipes are crucial for the transmission of liquids, gases and free-flowing solids, hollow profiles are used for mechanical structures. According to a report published by the market research company Core Market Research in June 2025, Southeast Asia’s pipes market is expected to reach a valuation of nearly US$6 bn in 2025 and to grow to US$12 bn by 2035 at a CAGR of around 6.5% during this period. The dynamics of this market are influenced by the different levels of industrialization and infrastructure development across the ASEAN countries.

Steel pipes are essential in various industries, including the transport of oil and natural gas, construction and wastewater management. Properties like mechanical strength, durability and the ability to endure high pressure and temperatures make these pipes suitable for critical applications. There is also a growing demand for durable and economic piping solutions in water supply systems and agricultural irrigation systems. Plastic pipes, on the other hand, have gained a substantial market share due to their lightweight, durability, low cost compared to pipes of other materials, corrosion resistance and ease of installation and are thus favoured for construction, water supply, water sewage and irrigation systems. The market research company Grand View Research found out that the size of the Southeast Asian plastic pipes market amounted to about US$9.1 bn in 2024 and expect it to grow from 2025 to 2030 to more than US$20 bn by 2030 at a CAGR of 14.3% (Fig. 2).

Outlook

In view of increasingly challenging market requirements, wire, cable and tube manufacturers in Southeast Asia need technologically up-to-date equipment to remain competitive. The wire Southeast Asia and Tube Southeast Asia trade fairs provide an ideal opportunity for suppliers to show their innovations while visitors get access to information about the state-of-the-art.

www.wire-southeastasia.com | www.messe-duesseldorf.de | www.wire.de

Messe Düsseldorf GmbH

Messeplatz, Stockumer Kirchstrasse 61

40474 Düsseldorf/Germany

Tel.: +49 211 4560-01

info@messe-duesseldorf.de

www.messe-duesseldorf.de