12/02/2020

Increasingly electrified

According to the German Association of the Automotive Industry (VDA), electric vehicles are suitable for the market. A “young, still small market with high dynamics” has developed around e-cars – even though vehicles with combustion engine technology currently still dominate the global automotive market. Suppliers of the wire and cable industry are already picking up speed and see e-mobility as an opportunity.

“The market potential is enormous,” Wafios emphasises. “Accordingly, the forecasts are positive.” For this reason, e-mobility became the focus of the company's attention already some years ago. “Technical triggers were enquiries from the automotive sector, both on the OEM side, supplier level and in the equipment sector about three years ago,” explains the supplier of machines for bending wire and tubes. E-mobility picked up speed.

However, the industry is still “clear and concentrated on a few market participants”, explains Wafios. According to AlixPartners Global Automotive Outlook 2019, the global market share of electric drive units in terms of vehicles sold amounted to 2.7% in 2018. A share that is clearly expandable, which is shown by the growth rate of the e-drive of more than 65%. Thus, according to Outlook 2019, the market is speeding ahead “in the irreversible market run-up”.

Faster than expected

According to the VDA, electric mobility is coming faster than many expect. One reason is, for example, the tightening of regulations and the improved incentive systems for electric mobility in order to reduce CO2 emissions. For example, there will be no new registrations for conventional drives in Norway from 2025 – the sale of electric cars will be promoted with massive tax incentives. The Netherlands, Ireland and Israel want to use only emissions-free vehicles from 2030. A sales ban on combustion engines is planned from 2040 in Great Britain and France. In the USA some states, such as California, plan to permit only emissions-free cars from 2040. In order to get their act together, suppliers have to target these figures.

Globally, a drastic increase in hybrids and electric vehicles can be expected between 2020 and 2025. The VDA predicts that “by 2030 a production share of electrified vehicles of 60 per cent or more worldwide is likely”. China will be a pioneer here - every third vehicle could be fully electric by 2030. In Western Europe, the share could rise to 25 per cent due to stricter regulations and driving bans. According to the association, a breakthrough in Africa and South America is not to be expected so soon. For Japan, Korea and North America, a share of hybrid vehicles of around 80 per cent would be conceivable. The car world is electrified – a realistic view.

Huge investments

Car manufacturers and automotive suppliers must therefore make massive investments: The AlixPartners Global Automotive Outlook 2010 reports that at least 202 billion euros will have to be spent globally over the next five years to master the technological change to the electric drive and the development, production and marketing of up to 300 planned new e-vehicles. “The level of investment is still out of all proportion to demand,” says Dr Elmar Kades, Global Co-Lead Automotive and Managing Director at AlixPartners. At the same time, the current and expected weak sales development for the next few years will increase the short-term pressure on the margins and cash flows of the suppliers, Kades continued. Weak sales and massive investments therefore coincide.

Even though the situation is challenging, the wire and cable industry remains optimistic. “Electrically powered vehicles promise higher sales for our company because more or higher quality cables are needed,” explains Leoni. Hybrid vehicles, in particular, which contain both an electric and a combustion engine, require a higher product share from the company.

High-quality cables are required in various areas of the electric car: In the charging cable from the charging station to the vehicle system and from the charging connection to the battery. Lines finally transport the electricity via the inverter to the electric motor. The internal wiring supplies other high-voltage components, such as air-conditioning compressors or electrical heating, with energy. Electrifying outlook...

Battery cabling and connector systems

Leoni is focusing, in particular, on the high-voltage battery as an energy storage device for electric vehicles and plug-in hybrids. The company concentrates primarily on data and power distribution within high-voltage batteries. “We assume that the HV battery in future vehicles will contain parts of the previously exposed high-voltage cable harness due to its large-area arrangement.” The aim is to offer customers system solutions for battery cabling from a single source. Together with its partner Diehl, the company is working on offering complete solutions. Already established products of both companies in areas such as cabling, connector systems and cell contacting would be combined to form a complete package. This means that sustainable strategies are needed.

Laser for copper welding

Trumpf is also experiencing electric mobility as a growth-promoting driving force. A central role is played by a new laser, the development of which the laser specialist has accelerated in the course of its e-mobility strategy and which, according to the company, is proving to be very suitable for welding copper. Copper is considered to be the most important material for conducting electricity and an electric car would be inconceivable without it. With the new laser, copper can be efficiently welded, for example, for the high-performance electronics of electric cars. “The shift towards electromobility offers great opportunities for German industry,” emphasises Christian Schmitz, Managing Director for Laser Technology at Trumpf. The company expects further growth for its own business as a result of the changes in the automotive industry. Compared to the previous year, the company's sales of products and solutions that flow directly into electromobility have doubled. “20 per cent of our order intake from the automotive industry now comes from electromobility, twice as much as last year,” Schmitz continued.

Products and processes are changing

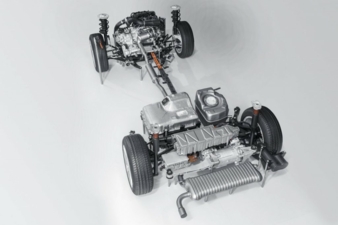

Changing times require flexible suppliers – the right curve position is crucial. You must bear in mind that the exhaust gas and fuel system, the combustion engine and the low-voltage vehicle electrical system are not required for the less complex electric drive. Instead, they must adapt to electric motors, cooling systems for electronics and batteries, chargers, a high-voltage electrical system and a PTC heater – components that sometimes require high-performance wires and cables to prevent vehicles from stuttering.

The changes associated with the switch from combustion to electric vehicle technology are therefore fundamental and affect products and processes. “Competencies such as blow moulding, pipe extrusion and machining technology are also becoming less important, while processes such as winding processes and forming techniques for parts made of aluminium and magnesium are gaining in importance,” explains the VDA. In order to continue on the road to success, the wire and cable industry must therefore flexibly steer in the right direction. Then it will head full speed towards high profits.

Innovative technologies will be presented at wire and Tube from 30 March to 3 April 2020 at Düsseldorf Fairgrounds.

Messe Düsseldorf GmbH

Stockumer Kirchstrasse 61

40474 Düsseldorf/Germany

Tel.: +49 211 4560-01

info@messe-duesseldorf.de

www.messe-duesseldorf.dewww.wire-tradefair.com