13/11/2019

Orders for metal forming slow down machine tool descent

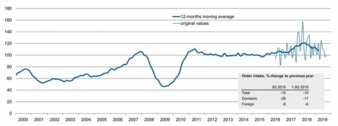

The order intake for the German metal forming technology sector in 2019’s third quarter is 15% down versus the prior-year period. National orderings declined by 26%, foreign orders fell by 8%. In the first nine months, they sank by 10%. Domestic orders were down 17% and foreign orders 6%.

Frankfurt a.M./Germany (VDW) – Wilfried Schaefer, Managing Director of the German Machine Tool Builders Association VDW, emphasises that the industry never before had been confronted with such an accumulation of factors, which all have a negative impact on business, namely a cyclical downturn coupled with trade conflicts and an unstable state of the largest customer, the automotive industry.

In all three months of the third quarter, orders from the Euro countries had fallen by more than 30%. For 2019 as a whole, Oxford Economics –VDW’s forecasting partner – doesn’t expect any effective recovery in demand from Europe. Business in Asia was also worrying, says Schaefer. As the stimulus provided by US financial policy expires, the American market also would become more difficult. The economic climate was generally clouded and would cause restraint in investments, even if the mood at the very current periphery is gently brightening. In this respect, the VDW had lowered the production forecast for 2019.

Forecast for 2019 revised downwards

“In view of the sharp drop in orders in the current year, it will no longer be possible to maintain the targeted moderate decline in production,” explains the VDW Managing Director. The association is now assuming a decline of 4%, which will be supported by the realisation of the order backlog. The gradual stabilisation of demand expected last summer for the second half of the year had not been confirmed. Capacity utilization last fell to 86.9% in October from 87.9% three months earlier. “The real problem is foreseeable for the year 2020 due to shrinking inventory orders,” says Schaefer. In the current year, hardly any significant buffer can be built up. The anticipated recovery in demand in 2020 is also only very moderate after the deep fall. This is also reflected in the forecasts for international machine tool consumption. With a minus of a good 4% in the current year, the best case is still described here as a moderate baseline scenario. The calculation of the rates of change in national currencies also has a stabilising effect.

The machine tool industry is one of the five largest branches in Germany’s mechanical engineering sector. It supplies production technology for metalworking to all branches of industry and contributes significantly to innovation and productivity progress in industry. Due to its absolute key position for industrial production, its development is an important indicator for the economic dynamism of the entire industry. In 2018, the sector with 73,500 employees produced machinery and services worth 17.1 billion Euro in companies with more than 50 employees.